WHICH PREMIUM CREDIT CARD IS THE BEST?

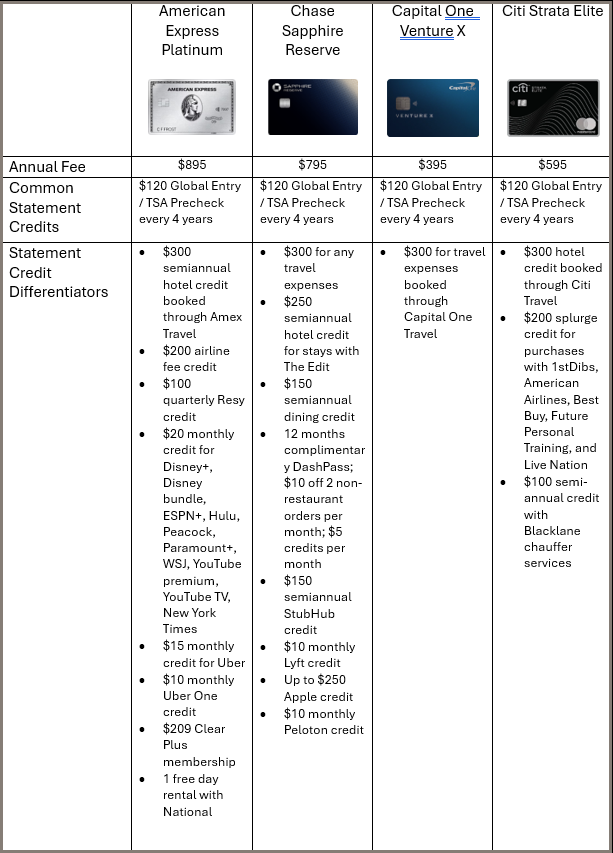

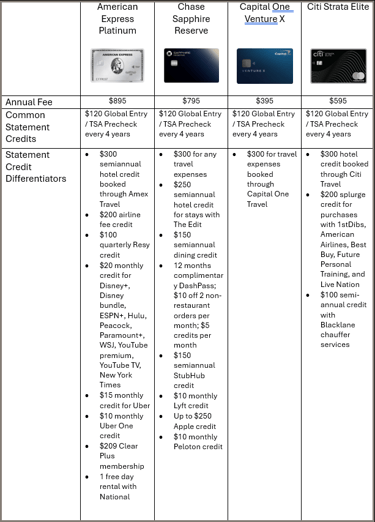

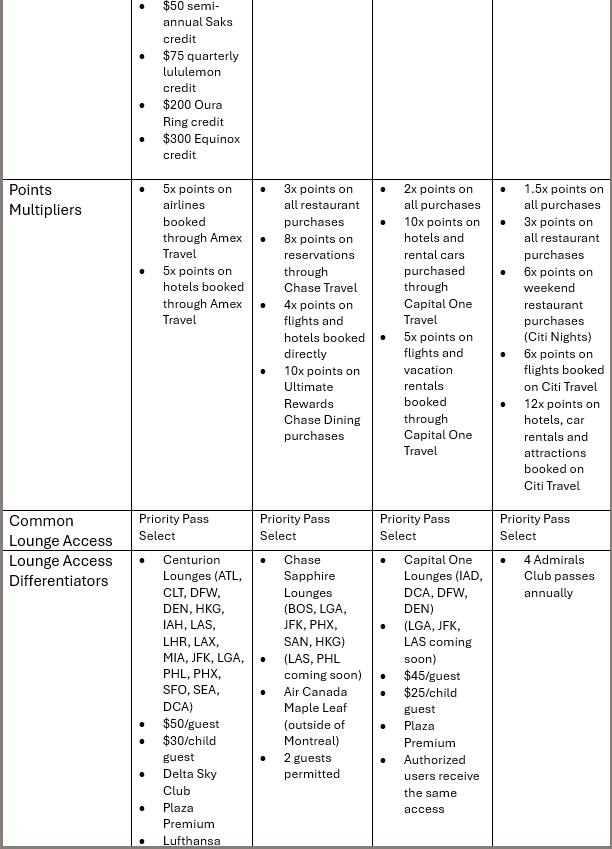

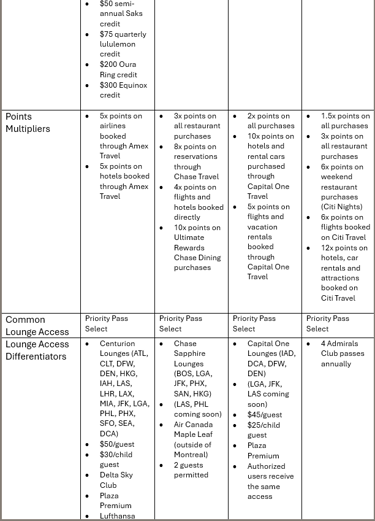

A comparison of the American Express Platinum, Chase Sapphire Reserve, Capital One Venture X, and Citi Strata Elite credit cards.

Craig Turck

3/24/20256 min read

In this blog I’m taking on the premium cards; the American Express Platinum card, the Chase Sapphire Reserve, and the Capital One Venture X. Each has a unique offer and promises elevated benefits and travel comfort. Does one stand out above the others? Let’s have a look at what they all offer, including characteristics which differentiate them from each other.

This article covers:

Annual Fees and Credits

Bonus Points and Multipliers

Lounge Access

Elevated Status

Additional Benefits (reimbursement, insurance, protection coverage)

Summary

Comparison Table

Annual Fees and Credits

Each card comes with hefty annual fees. American Express Platinum leads the way at $895, Chase Sapphire Reserve follows at $795, then Citi Strata Elite at $595, and the Capital One Venture X is at $395. Each of them, however, offers credits toward purchases which can offset those fees. Those credits should only be considered as a fee offset if you would have spent money on them anyway. For example, a monthly Uber credit should only be considered if you normally use Uber for transport. Taking Uber when you normally don’t, only to earn the credit, is NOT saving money.

American Express boasts over $3,500 in available credits, more than fully offsetting the annual cost of the card. Personally, I frequently dine at some of the local Resy restaurants, frequently use Uber, have the Disney bundle, and our family Saks bill easily tops the $50 semiannual credit, so we enjoy $892 in credits annually before considering the travel benefits. I can safely say I fully offset the cost of the card each year.

Chase offers with Sapphire Reserve a $300 travel credit, $250 semi-annual hotel stay credit with The Edit, $150 semi-annual dining credit at Sapphire Reserve Exclusive Tables, monthly DashPass, Lyft and Peleton membership credits. In my blog “Is the New Chase Sapphire Reserve Card Worth Keeping”, I do a full analysis of the credit buy-down in my case, and arrive at $15 per year out of pocket before considering the travel benefits, so again I find this card to be worth the annual fee.

With Capital One, the math is fairly easy. They offer a $300 credit for travel booked through Capital One Travel. I’m not normally a fan of the travel services for booking airfare or rental cars, but Capital One has put several layers of protection in place to ensure your flight and hotel prices are competitive, and the treatment and perks associated with booking through the service are worth it. Combine the $300 credit with the annual bonus of 10,000 miles, which has a minimum value of $100, and the cost of the card is completely offset.

Citi boasts nearly $1,500 in value with their Strata Elite card. To use most of their credits, however, would require lifestyle changes for me. In other words, I would need to spend money I normally don’t to gain the hotel and the Blacklane credits. I might use the Splurge credit with Best Buy, but not with the other brands. So, in the end, I would recover very little of the annual fee. In my case, the credits for this card do not bring value like those of the others.

Bonus Points and Multipliers

The advertised bonuses of each card are similar, with American Express and Citi at 80,000, Captial One at 75,000, and Chase at 60,000. If you’re looking at the Amex Platinum card, though, I would encourage patience until you find an increased sign-up bonus offer. I’ve seen it as high as 175,000.

While the Amex sign up bonus can set them well above the others, the card fails to stand up to the others with ongoing use. Amex offers only 1x points on purchases not booked through Amex Travel. Compare that to the Chase Sapphire Reserve, which earns 4x points on hotels and flights booked directly and 3x points at restaurants, The Citi Strata Elite which earns 3x-6x points at restaurants and 1.5x points on everything else, and the Capital One Venture X, which earns 2x points on everything. The points tend to add up much more quickly on those cards. A monthly spend of $1,500 on the Venture X card, for example, equals 9,000 additional points per year over the Amex Platinum.

Lounge Access

With a much broader network of lounges, it would seem the American Express Platinum card would be the hands down preferred card in this area. They all share the base of 1,300+ lounges with the Priority Pass collection, but beyond these, Amex has many more options. Chase and Capital One are opening more lounges, but American Express still has them at least doubled in Centurion Lounge locations. Add on top of this the Delta Sky Club, Lufthansa, and Plaza Premium lounge access and it is clear the Amex network is second to none. The size of the network may not matter as much as the locations, based on a traveler’s home base. As an example, a Washington, D.C. based traveler will find a Centurion lounge at Reagan Airport and a Chase lounge at Dulles (Etihad Airways Lounge), but will find Capital One lounges at both Reagan and Dulles Airports. Citibank does not have any airport lounges but offers 4 Admirals Club passes annually with the Strata Elite card. There is a good network of Admirals Club lounges, but for the frequent or family traveler, those passes may be used up quickly.

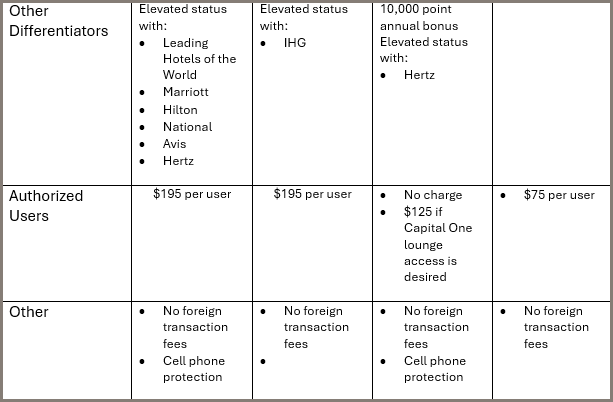

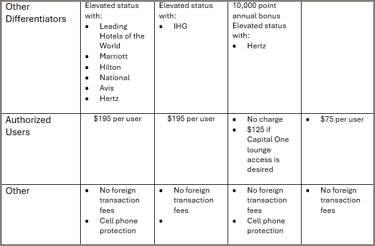

While Centurion lounges more than double those of their competitors, they have become quite popular and, as a result, quite crowded. Space is not always available. As a result, Amex has tightened up their guest policy a bit. Guests are no longer welcomed free of charge in the Centurion lounges. Adult guests cost $50, and children $30. Capital One has followed suit, and charge $45 for adults and $25 for children. At Chase lounges, two guests are still free. Access can be increased through adding Authorized Users to a card, but this costs a pricey $195 per user for the Amex Platinum and Chase Sapphire Reserve, and $125 for the Capital One Venture X (if lounge access is desired). This fee gets the Authorized User lounge access with their card, but most the other card benefits remain at the account level. Authorized Users can be added to the Strata Elite card at $75, with no apparent benefits at the card level.

Elevated Status

Status brings perks such as early check in, late check out, and shorter lines. Here the Platinum card stands apart from the others. It offers elevated status at Marriott, Hilton, Avis, Hertz, and National. With its latest upgrade, Amex has added Sterling status with Leading Hotels of the World. This is a collection of the best hotels anywhere as rated by readers of Travel and Leisure magazine. Benefits of this status include 5 pre-arrival upgrades per year and elevated rewards points awarded for each stay, along with on-property benefits.

Chase offers elevated status at the IHG, and Capital One offers elevated status with Hertz. No such status is provided by Citi.

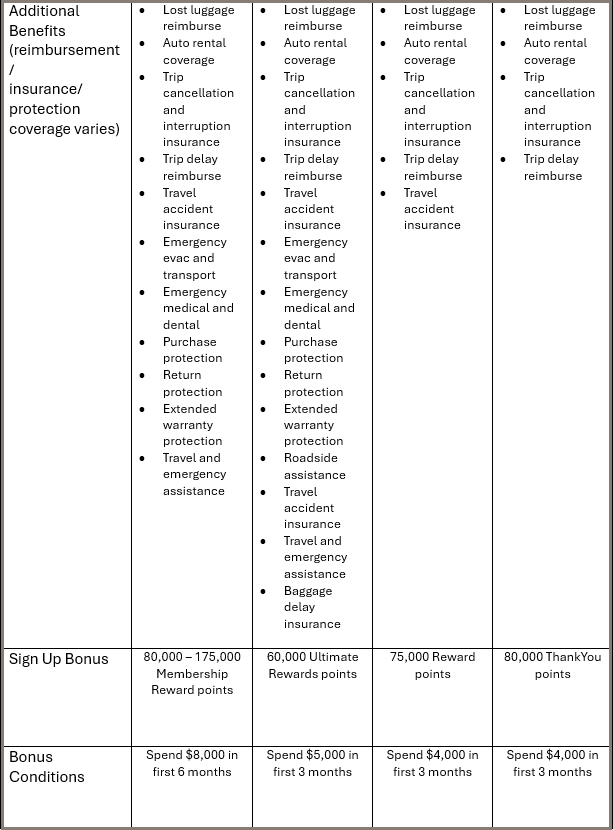

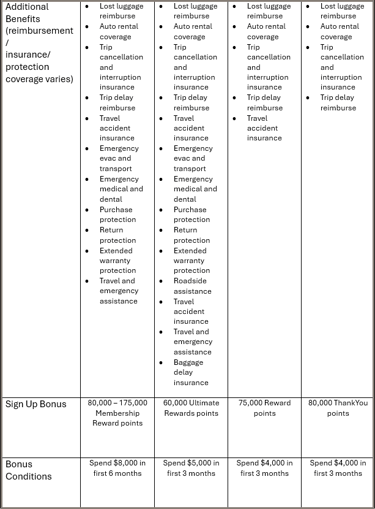

Additional Benefits (reimbursement, insurance, protection coverage)

Each card provides extensive coverage, not only in travel insurance, but also in purchase and return protection, as well as extended warranty. We've listed the benefits at a high level in the table below. For a more detailed analysis, see our blog: PREMIUM CARD COMPARISON - THE FINE PRINT | Max Your Plastic

Summary

So, which one is the best? It depends on your location, travel habits and spending habits. The table below gives a good side-by-side comparison of each. If you seek guidance as to which card is best for you, or for a plan on how to maximize your returns on the credit cards in your wallet, send us an email at email@maxyourplastic.com.

What do you think of this blog? Let us know your thoughts, any positive or negative experience you have had with lounge access, or any experiences with any of the other benefits each of the cards has to offer.

Comparison Table